China’s transition from QR code payments to full-scale facial recognition payment systems signifies a significant change in the execution of daily transactions. What started as a nationwide push toward cashless payments via smartphone apps has culminated in a system where a single glance at a camera can instantly authorize a purchase. This shift, driven by major digital wallets like Alipay and WeChat Pay, has reshaped small business operations, streamlined checkout speeds, and cemented China’s status in digital commerce.

The widespread adoption of Face Pay is more than a simple technological upgrade; it introduces complex questions around biometric data sensitivity and consumer consent. This rapid adoption—from the street market to the metro gate—requires examining the underlying infrastructure, the regulatory response, and the new data trail created when a face becomes a receipt. We explore how China balanced technological speed with the ethical demands of protecting personal information.

The Shift from Rented Clouds to Private Ecosystems

Key Milestones in Face Pay Adoption

- Launch Year: 2017, with Alipay’s Smile to Pay debut at a KFC concept store in Hangzhou.

- Technology Backbone: Facial recognition combined with Alipay or WeChat Pay accounts.

- Primary Sectors: Quick-service restaurants, grocery chains, vending kiosks, and metro transit systems.

- Regulatory Milestones: Personal Information Protection Law (2021) and the 2025 measures that prohibit forced facial recognition.

- Adoption Motivation: Reduce checkout friction, enhance speed, and integrate loyalty programs.

Privacy Safeguards focus on three core protections:

- Required consent before enrollment.

- Visible signage indicating facial recognition is active.

- User choice for alternative payment methods.

How QR Code Payments Transformed Street Commerce

Before face scanning entered the picture, QR code payments had already transformed how everyday transactions occurred across China. By the mid-2010s, scanning a black-and-white square had become second nature for millions of consumers. The People’s Bank of China issued barcode and QR payment standards for non-bank payment institutions, ensuring that these low-cost solutions could serve both high-end retail stores and the smallest food stalls.

What made QR adoption revolutionary was its simplicity. Any vendor could print a payment QR linked to an Alipay or WeChat Pay account and start accepting digital payments without special hardware. This brought small merchants into the cashless economy without the infrastructure burden of card terminals. Mobile wallets replaced cash as the preferred method for most daily transactions, from taxis to night markets.

China’s transition unfolded alongside a global shift toward online payments and a more cashless society, with digital wallets increasingly displacing cash and cards. At street level, the system relies on quick response barcodes that encode payment details in dense black-and-white squares that any modern smartphone camera can decode almost instantly.

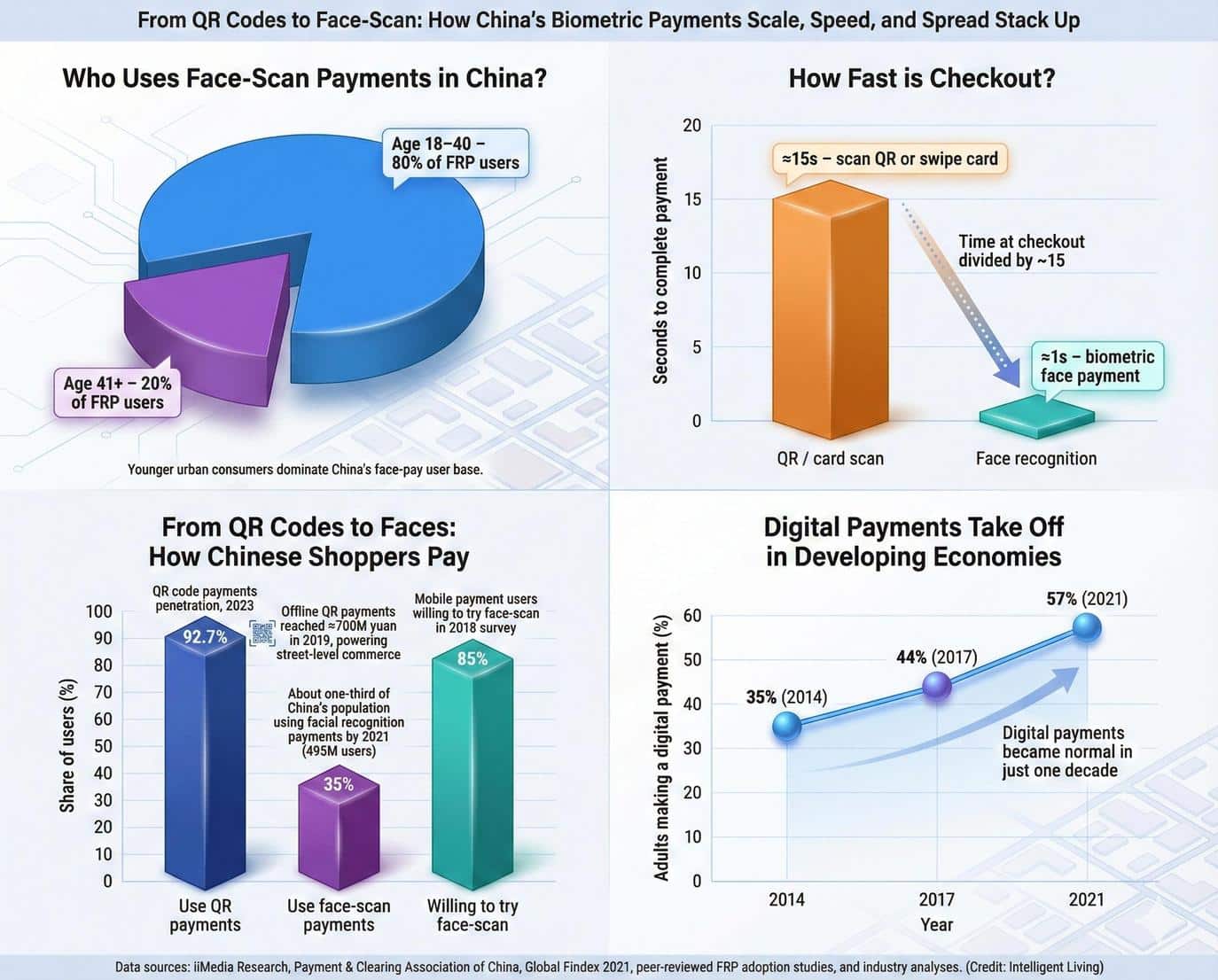

Still, while QR payments created a fast and reliable foundation for digital commerce, they relied heavily on smartphones. As payment volume increased, small inefficiencies—like unlocking a phone, switching between apps, or scanning errors in low light—became noticeable friction points in an otherwise seamless system.

Addressing the Friction: Why Biometric Checkout Emerged

The push toward facial recognition payment systems began as a response to those remaining micro-frictions. Even a few extra seconds per transaction add up when multiplied across thousands of customers in supermarkets and transit systems. Face Pay promised to eliminate those seconds by allowing users to simply look at a camera to confirm their identity, automatically linking the face scan to their existing digital wallet.

Beyond efficiency, this shift also allowed companies to connect payments to user profiles more directly. A successful scan not only processed a purchase but could also log a customer into loyalty programs or provide personalized offers. For businesses, this integration meant improved marketing insights and faster checkout throughput. For consumers, it meant walking into a store and leaving without ever pulling out a phone—a vision that felt futuristic but was quickly becoming common in cities like Hangzhou and Shenzhen.

However, this innovation wasn’t without tension. Many citizens questioned what would happen to the biometric data collected at payment points. The Personal Information Protection Law (PIPL) later established clear boundaries, defining facial data as sensitive information that requires explicit consent and secure handling. These safeguards would become central to the next stage of China’s digital payments evolution.

How Facial Recognition Payments Work at Street Level

From a user’s perspective, enrolling in a facial payment system is relatively simple. Consumers register their face through an Alipay or WeChat Pay app, which creates a digital template used for authentication. At checkout, a camera-equipped terminal captures a live image and compares it to the stored template to verify the user’s identity. This process utilizes computer vision techniques already common in healthcare diagnostics and retail analytics to recognize faces under changing lighting and viewing angles. To prevent fraud, modern systems employ liveness detection, ensuring the camera sees a real person instead of a photo or video.

Once verified, the payment is automatically deducted from the user’s linked wallet. Unlike traditional phone-based transactions, there is no need to scan or tap—the system recognizes the customer instantly. For small businesses, this means less waiting time at the counter and fewer failed scans due to damaged or unreadable codes.

At the same time, it introduces new responsibilities. Merchants must now comply with consent requirements and clearly display signs indicating that facial recognition is being used. Data is stored under strict encryption standards, and under China’s 2025 cybersecurity measures, businesses must offer an alternative payment option for those who prefer not to use their face.

These systems depend on privacy-focused user experience patterns that make consent, data flows, and transparency part of the interface instead of hidden legal fine print.

Where Face Pay Spread First: Kiosks, Grocery Chains, and Convenience Retail

The earliest public trial of Face Pay occurred in 2017 at a KFC concept store in Hangzhou, where Alipay rolled out its Smile to Pay facial recognition checkout. Customers ordered at self-service kiosks, looked into a camera, and confirmed the purchase with a linked phone number. It was a milestone moment that signaled the arrival of biometric checkout in mainstream retail.

Soon after, Alibaba’s Hema grocery chain and other major retailers began integrating facial payment terminals into their checkout counters. These devices, often referred to as Dragonfly or Frog Pro systems, combined high-resolution depth cameras with compact POS hardware that could plug into existing store setups and into payment gateways that route digital transactions between wallets, banks, and card networks. The result was an affordable pathway for smaller merchants to experiment with biometric payments without massive infrastructure costs.

Kiosks and self-service counters became natural entry points because they already required customer interaction with screens and cameras. For convenience stores and supermarkets, the benefit was tangible: faster checkout lines and the ability to tie purchases directly to membership programs. In some stores, customers could earn points or access exclusive discounts immediately after scanning their face.

While adoption grew rapidly among chain retailers and urban metro systems, smaller businesses remained cautious. Hardware costs, regulatory uncertainty, and public debate around data privacy slowed wider uptake. Nevertheless, Face Pay demonstrated how China’s digital payment landscape continues to evolve, blending advanced biometrics with everyday transactions.

Similar biometric payment ideas are appearing elsewhere, including palm-based checkout systems that link hand geometry directly to digital wallets in Western pilots.

Transit Made it “Infrastructure”: Face-Scan Gates and Auto-Deduct Fares

China’s public transportation networks played a crucial role in making Face Pay feel ordinary. In cities such as Zhengzhou and Guangzhou, metro stations began installing face-scanning check-in systems that let passengers pass gates with a quick glance instead of a ticket or phone. Once registered through official apps, commuters could have fares automatically deducted from their linked payment accounts.

This integration into public infrastructure accelerated trust in biometric payments. When millions of people used face scans daily to board trains or buses, the technology shifted from a novelty to a normalized convenience. Transit authorities gained operational benefits, reducing congestion at entry points and minimizing physical contact—an efficiency that became especially relevant during public health concerns.

The metro gate system also revealed scalability lessons for other sectors. The same algorithms managing high-volume verification in stations could be adapted for retail environments, proving that face recognition was robust enough to handle real-world pressures such as lighting changes and crowd density.

What it Changed for Small Businesses (Operations, Friction, and Failure Modes)

Streamlining Checkout and Engagement

For small and medium-sized merchants, Face Pay introduced both opportunities and new operational demands. On the positive side, it simplified checkout by removing dependence on QR posters or customer smartphones. This allowed faster transactions during peak hours and reduced waiting times in busy street markets or cafés.

Challenges of Implementation and Trust

However, implementation costs and maintenance posed challenges. Hardware terminals with depth cameras required investment, and staff needed basic training to manage exceptions—such as failed recognitions or customers who opted out of face scans. Unlike QR payments that relied on nearly universal smartphone ownership, facial recognition terminals demanded upfront infrastructure.

Operationally, the transition also highlighted a new type of friction: trust management. Merchants had to reassure customers that their biometric data would be protected and not misused. Clear communication, visible consent notices, and offering alternative payment options became essential for maintaining customer confidence. Owners who rely on connected payment terminals increasingly need AI-era small business cybersecurity practices that cover endpoint protection, access control, and real incident response.

Despite these hurdles, many business owners found value in the long-term efficiency and marketing potential of biometric systems. Loyalty integration allowed repeat customers to receive personalized offers instantly, turning the checkout counter into a subtle engagement platform.

The New Data Trail: Linking Biometrics to Transaction History

Each facial recognition transaction produces a new kind of data trail. Unlike anonymous cash payments or device-specific QR scans, Face Pay links transactions directly to a verified biometric identity. This connection creates a detailed history that precisely tracks spending behavior, location, and frequency.

These insights can enhance convenience through automatic loyalty credits or personalized recommendations. However, they also raise critical privacy and sustainability questions. As societies lean into digital payments, cashless transaction patterns are reshaping the carbon footprint of money movement, adding energy use to the list of concerns. The Personal Information Protection Law (PIPL) classifies facial data as sensitive, requiring explicit consent, secure encryption, and limited retention. Under the 2025 regulatory measures, businesses collecting such data must prominently display notices, store it safely, and allow users to opt for non-biometric alternatives.

Experts argue these safeguards represent a turning point where technology and ethics intersect. The primary challenge remains balancing the efficiency of Face Pay with the consumer’s right to anonymity. As more systems rely on identity-linked authentication, understanding how biometric information is processed becomes essential for maintaining user trust.

China’s Guardrails Catch Up: Consent, Alternatives, and “No Coercion”

In response to public concern, China’s regulators introduced stricter controls to govern biometric data use. The 2021 Personal Information Protection Law laid the foundation by identifying facial recognition as sensitive data. These new controls were further strengthened by facial recognition regulations issued by the Cyberspace Administration of China in 2025, which explicitly prohibits private businesses from coercing users into facial verification. These rules sit alongside the Measures for the Security Management of Facial Recognition Technology, which require companies to provide alternative payment methods and display clear signage wherever facial recognition is active.

These guardrails are particularly significant for small retailers, who may not have dedicated compliance teams. Clear communication of consent policies and routine data audits are encouraged to meet the new standards.

Large-scale operators, such as transit systems or chain retailers, must also file usage reports if their systems manage biometric data for hundreds of thousands of individuals, reflecting judicial interpretations on civil cases involving facial recognition processing.

These policies collectively signal a shift toward greater transparency and accountability in the digital economy. They ensure that innovation in convenience does not come at the expense of personal autonomy.

Global Lessons in Biometric Checkout and Data Governance

China’s rapid adoption of Face Pay provides critical insights into how quickly a technological curiosity can become a daily habit when supported by infrastructure, consumer trust, and robust regulatory frameworks. This model proves that biometric checkout dramatically reduces transaction friction, but it concurrently establishes a crucial need for clear legal boundaries. However, the experience also serves as a cautionary tale for other nations. The key takeaway for other nations is not the technology itself, but the necessity of setting strict rules on data retention and forced participation before mass adoption occurs.

Moving forward, the primary lesson from this era of facial recognition payment is the requirement for transparency. Practical safeguards—such as building consent flows, setting limits on data retention, and providing non-biometric alternatives—must be central to any innovation strategy. The true measure of success for any biometric system is its ability to integrate seamlessly into public life without compromising personal autonomy or anonymity.

Essential Questions on Biometric Payments

Is Facial Recognition Payment Mandatory in China?

No. The 2025 regulations explicitly require that users be offered alternative payment options. Participation in Face Pay systems must remain voluntary.

What Happens if I Refuse to Use Face Pay?

Consumers can still use traditional methods such as QR codes, cards, or cash where accepted. Businesses must provide a convenient alternative to ensure accessibility for all users.

Is Face Pay Safer than QR Code Payment?

Each system has distinct risks. QR payments depend on device security, while Face Pay introduces biometric data sensitivity. Strong encryption and liveness detection help secure Face Pay, but privacy risks remain if data governance is weak.

Where is Face Pay Most Widely Used?

Urban centers such as Hangzhou, Guangzhou, and Shenzhen show the highest adoption, especially across grocery chains, transit networks, and automated kiosks.

What do the 2025 Regulations Mean for Businesses?

Merchants must clearly notify customers, obtain explicit consent, and store biometric data securely. Larger companies handling mass facial data may need to file compliance records with regulators to maintain operational transparency.