Across the world, a new kind of race is unfolding—not for oil or territory, but for the minerals that power the technologies of clean energy. Nations in the BRICS+ bloc and the G7 alliance are competing to secure supplies of lithium, copper, rare earth elements, and other materials essential to electric vehicles, batteries, and wind turbines.

At the heart of this competition lie regions like Greenland, Latin America, and Venezuela, where the push for energy independence is colliding with local environmental realities and community rights. Critical minerals serve as the fundamental backbone of the green transition, yet their extraction has sparked new tensions over ownership, access, and control as sustainable abundance and regenerative capitalism collide with older extractive logics.

The story is no longer about who drills for oil; it is about who digs for lithium and who sets the global rules of this next great resource economy. These mineral frontlines now redefine global power dynamics, forcing major nations to deploy tariffs, sanctions, and military posturing to safeguard their industrial survival.

Essential Statistics of the Global Critical Mineral Race

Understanding the scale of the global critical mineral race requires looking at the raw data defining our industrial shift. The following statistics highlight the massive surges in demand and the geographical concentration of lithium production and rare earth elements.

- Global Demand Surge: According to the International Energy Agency, demand for lithium jumped by more than 30% in 2024, with similar growth projected for nickel, cobalt, and rare earth elements.

- Supply Concentration: Three countries control more than 80% of global production for several key minerals, while China dominates refining for 19 of the 20 most strategic materials.

- Greenland’s Hidden Wealth: Geological surveys reveal that Greenland contains 25 of the 34 critical raw materials listed by the European Union, including lithium, zinc, and rare earth elements.

- Latin America’s Tonnage Advantage: The Lithium Triangle of Chile, Argentina, and Bolivia holds nearly 60% of the world’s lithium resources, while the region accounts for around 40% of global copper production.

- Venezuela’s Untapped Potential: Despite holding about 17% of global oil reserves, Venezuela also possesses underdeveloped deposits of gold, bauxite, and coltan that are increasingly attracting global attention.

These figures illustrate how the green energy transition is fundamentally reshaping global trade. As nations scramble for access, the balance of power shifts toward those who control these essential inputs.

Critical Minerals and the New Resource Fault Lines of Global Power

To understand the current resource geopolitics, we must first define the materials at the centre of the storm. The term “critical minerals” refers to materials essential for national security but vulnerable to supply chain risks.

- Essential Elements: These include high-value materials like lithium, nickel, cobalt, and copper.

- Rare Earths: The 17 rare earth elements are used in everything from electric motors to smartphones.

- Strategic Value: Materials that underpin the infrastructure of modern decarbonisation efforts.

As governments finalise their decarbonisation strategy, these minerals have become indispensable assets. Their scarcity ensures that every new discovery becomes a focal point for diplomatic and economic competition.

Throughout much of the 20th century, oil dictated the global balance of power. Control over petroleum routes determined military alliances, trade partnerships, and wars. Today, the same dynamics are emerging around minerals. Demand for energy technologies could quadruple by 2040 as breakthroughs in critical minerals reshape industrial expectations.

China’s Refining Dominance and the G7 Alliance Strategy

China’s grip on refining and processing now stands as a defining economic advantage for the BRICS+ bloc. It’s not just about the raw materials; this leverage directly fuels their battery manufacturing leadership and strategic AI hardware.

The nation refines over 70% of global lithium and more than 80% of rare earth elements, giving it leverage over manufacturing for wind turbines and defence technologies. In response, the G7 nations are launching initiatives like the Minerals Security Partnership (MSP) to diversify sources through investment in friendly countries.

However, these strategies face inherent contradictions. While the rhetoric emphasises sustainability, the reality on the ground often looks like a replay of older extractive systems.

Mining projects in Latin America and Greenland raise urgent questions about water rights, Indigenous sovereignty, and biodiversity. The current mineral extraction rush risks replicating colonial extraction unless new governance models emerge.

Arctic Mineral Security: Greenland’s Strategic Rare Earth Elements

Greenland now occupies a central position in global strategic discussions due to its vast geological wealth. Beneath its icy surface lies an extraordinary concentration of untapped resources that could redefine Western energy independence.

- Rare Earths and Uranium: Essential for advanced electronics and nuclear power.

- Base Metals: Significant deposits of zinc and copper required for electrical grids.

- EU Strategic Materials: Surveys indicate that 25 of the 34 critical raw materials listed by the European Union are present on the island.

This positioning makes Greenland a future cornerstone of mineral security. As the ice recedes, the accessibility of these treasures increases, drawing the eyes of major global powers.

Climate change is also rewriting the island’s geography. Melting ice has begun to open Arctic sea routes that could shorten shipping distances. Securing specialised clean energy materials from these thawing zones can reshape ecosystems and intensify pressure on Indigenous lands.

U.S. Strategic Interests and Arctic Resource Sovereignty

The geopolitical stakes are high. In 2019, President Donald Trump publicly floated the idea of purchasing Greenland, citing national interest and defence strategy. More recently, U.S. officials have intensified diplomatic engagement, including the appointment of a Special Envoy for the Arctic.

The underlying motivation is clear: securing rare earth supplies and safeguarding Arctic trade routes against growing Russian and Chinese presence. Yet for Greenlanders, the mineral rush poses dilemmas that go beyond geopolitics.

Local communities face the tension between economic opportunity and environmental protection. Mining near glaciers threatens delicate ecosystems, while uranium and rare earth extraction raise concerns over contamination and sovereignty.

As environmental advocates and policymakers note, Greenland’s challenge is balancing self-determination with global demand—ensuring that the push for renewable energy does not come at the expense of Arctic sustainability.

Latin America’s Dominance in Global Lithium Production and Copper Mining

If Greenland represents the frontier of potential, Latin America is the engine of current production. The region’s vast copper and lithium deposits make it the decisive arena in the contest between BRICS+ and the G7. Chile and Peru alone account for nearly 40% of global copper output, while Argentina, Chile, and Bolivia hold close to 60% of the world’s resources.

The ongoing lithium rush in the region shows how state policy and Indigenous consent shape who actually prospers from the extraction boom. These minerals are essential to manufacturing electric vehicles, wind turbines, and high-capacity batteries.

The International Energy Agency projects that Latin America’s mining and refining industries could reach massive valuations this decade as global lithium discoveries reshape battery supply chains. But this growth also exposes a tension between economic opportunity and environmental stewardship.

Environmental Stewardship and Indigenous Rights in the Lithium Triangle

Lithium extraction is water-intensive, often draining fragile desert ecosystems that serve as the lifeblood for Indigenous communities. In northern Chile’s Atacama Desert, local groups have documented falling groundwater levels and ecosystem degradation near brine evaporation ponds. Similar conflicts have emerged in Argentina and Bolivia, prompting debates about who benefits from the green transition and who bears its costs.

Modern lithium extraction methods, including seawater processing, could help mitigate these impacts if properly implemented. By adopting these cleaner technologies, nations in the Lithium Triangle can protect their biodiversity while meeting global demand.

Geopolitically, the region mirrors the shifting polarity of the world economy. Chinese companies have invested heavily in South American projects, integrating them into BRICS+ networks. Meanwhile, the G7 alliance promotes “friendshoring” strategies to secure EUDR-aligned supply chains between the EU and the Mercosur bloc.

Yet despite global competition, Latin America’s future may hinge on its ability to chart an independent path. By prioritising transparent royalties, water protections, and regional cooperation, nations in the Lithium Triangle could redefine sustainability, especially if they adopt a circular battery economy that uses recycling to reduce mining pressure.

Venezuela’s Resource Paradox and the Orinoco Mining Arc Potential

Venezuela embodies a profound paradox on the global resource map. It holds an estimated 303 billion barrels of proven oil reserves, which is roughly 17 per cent of the world’s total, making it the largest single reserve holder globally. Yet decades of mismanagement, sanctions, and infrastructure decay have kept its oil output far below capacity.

While oil has historically dominated discussions about Venezuela’s wealth, its mineral potential likely rivals its massive petroleum endowment. Geological surveys identify the Guayana Shield and the Orinoco Mining Arc as high-value zones for diverse resources.

- Industrial Metals: Vast deposits of iron ore, nickel, copper, and zinc.

- Precious and Strategic Minerals: Significant gold, bauxite, and coltan resources.

- Geographical Scale: The Orinoco Mining Arc spans more than 110,000 km², an area comparable to many European nations.

Geopolitical Intervention and Foreign Investment in Venezuela’s Mineral Sector

These systems are estimated to hold trillions of dollars in mineral resources. However, the lack of formal extraction and verification means this wealth remains largely speculative on the global stage.

Despite this enormous endowment, formal investment in Venezuela’s mineral sector has been limited. Decades of political instability and a legal framework that discourages foreign investment have left much of the country’s mineral potential in the hands of informal operations. These irregular extractive practices often occur without environmental safeguards and fail to contribute meaningfully to state revenues, undermining local development.

The recent escalation of U.S. actions in Venezuela has underscored how resource considerations sit at the core of geopolitical strategy. While measures focus on drug trafficking and governance, domestic supply security remains a central subtext in the effort to build secure battery supply chains as strategic materials become an axis of global competition.

China’s longstanding economic ties with Venezuela add another layer to this paradox. Beijing has invested in Venezuelan oil and holds influence across parts of its supply networks, and the country’s mineral sector plays into broader rivalries over access to critical commodities throughout Latin America.

Venezuela’s case exposes a fundamental truth of the resource age: natural wealth means little without the capacity to harness it. Governance, investment climate, transparency, and environmental protections all shape whether minerals become engines of inclusive prosperity or sources of conflict and exploitation.

Navigating Threat Diplomacy and Stewardship in the Green Energy Transition

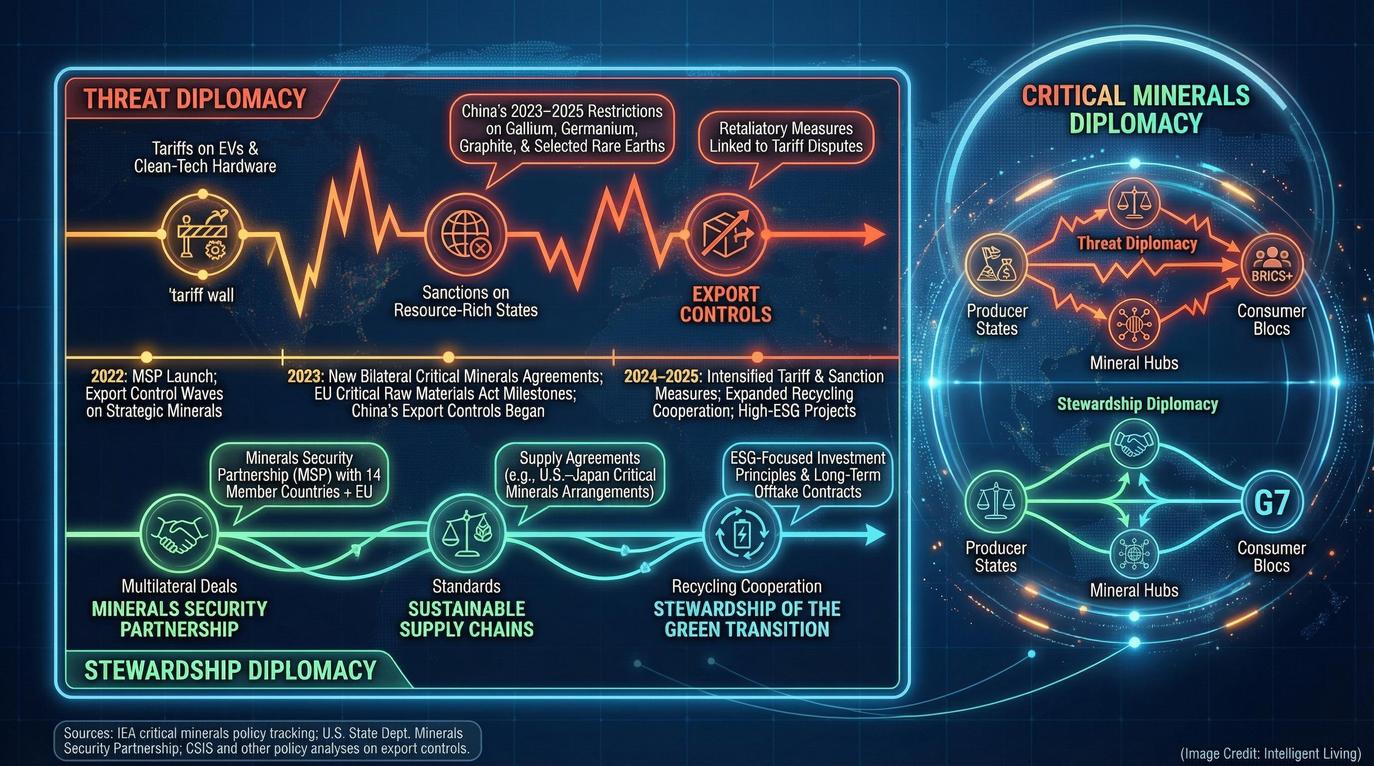

As the competition for critical minerals intensifies, nations reach for a diverse arsenal of diplomatic tools. At one end lies threat diplomacy, involving coercive measures such as tariffs, sanctions, and military posturing. At the other lies stewardship diplomacy, which emphasises cooperation, standards, and mutually beneficial frameworks for sustainable resource development.

In recent years, the United States has deployed aggressive pressure tactics to secure its strategic interests in the mineral race. These actions demonstrate how resource competition now blends directly with national security.

- Economic Leverage: Applying tariff threats against major mineral producers to influence trade.

- Financial Restrictions: Sanctions on oil and petroleum intermediaries to cut off revenue for rivals.

- Strategic Posturing: The use of military signalling or blockades to protect supply routes.

These manoeuvres highlight the shift toward coercive diplomacy. As competition intensifies, the line between trade policy and military strategy continues to blur.

The Role of Stewardship Diplomacy in Building Supply Resilience

Critics argue that such tactics risk fragmenting global supply chains and could provoke retaliatory measures. Past Chinese export controls on rare earth elements and strategic materials highlighted how vulnerable Western economies can be when supply is heavily concentrated under one geopolitical sphere of influence.

On the other side, stewardship diplomacy focuses on building stability and mutual benefit. This includes long-term offtake agreements between producers and consumers that provide financial certainty to projects while including labour, environmental, and community protections. Initiatives like the Minerals Security Partnership seek to coordinate investments in ethical mining practices and shared standards for environmental and social governance.

Stewardship-orientated diplomacy also embraces regulatory cooperation on recycling, reclamation, and technology transfer. Rather than relying solely on new extraction, stewardship frameworks attempt to integrate circular development models and shared governance norms across borders. For communities in mineral-rich regions, this approach offers the promise of more predictable revenues and stronger legal protections for water and land.

The difference between these two diplomatic postures matters because it shapes the incentives facing both producers and consumers. Coercive measures may deliver short-term leverage, but they often undermine long-term cooperation and resilience. By contrast, stewardship diplomacy aims to align strategic interests with broader goals of sustainability, equity, and shared prosperity.

Escaping the Extraction Trap Through a Circular Battery Economy

The rush for critical minerals risks trapping societies in cycles of environmentally destructive extraction. To avoid this, we must pursue long-duration storage technologies such as multi-day iron-air batteries for grid balancing.

Fortunately, three complementary pathways can help ease the pressure on our ecosystems. By focusing on circularity, substitution, and shared international rules, we can create a more resilient industrial base. These strategies move us away from a purely extractive logic toward a more sustainable global model.

Circularity: Reclaiming Metals from Global Waste Streams

Circularity means treating products not as disposable but as sources of reusable materials. Electronic waste and discarded devices contain recoverable quantities of copper, lithium, and rare earth elements. By investing in recycling infrastructure, societies can reduce the demand for virgin mining while creating local jobs. Reimagining urban waste streams for high-tech metal recovery supports this circular approach and strengthens supply resilience without expanding extractive frontiers.

Substitution: Innovation in Battery Chemistry and Storage

Substitution refers to developing alternative technologies that lower reliance on the most constrained resources. Researchers are exploring battery chemistries that use abundant materials or entirely new concepts. Implementing sand battery storage for net-zero cities can stand alongside electrochemical storage to reduce reliance on rare minerals and spread demand across a broader range of inputs.

Shared Rules: Harmonising Global Labour and Environmental Standards

Lastly, shared rules are essential because global supply chains now sprawl across dozens of competing jurisdictions. Harmonising environmental protections and transparency requirements can help prevent a “race to the bottom” where producers compete by weakening safeguards. Tracking biodiversity impacts through digital tools can link supply chains directly to community wellbeing. Multilateral frameworks that bind participant countries to common expectations can elevate responsible mining as a competitive advantage rather than a cost burden.

Taken together, these strategies offer a roadmap out of the extraction trap. They insist that how materials are sourced and reused should reflect societal values, especially as new carbon-based battery designs promise higher performance without simply scaling today’s extraction footprints.

Shaping the Future of Resource Geopolitics and the Green Energy Transition

The race for critical minerals is fundamentally redrawing the map of human power and prosperity. These materials are not just commodities; they are the active architects of our industrial future, determining which nations lead the green energy transition and which remain trapped in older extractive models.

The frontlines in regions like the Lithium Triangle and the Orinoco Mining Arc are where the abstract goals of global policy meet the concrete realities of community rights and environmental stewardship. A truly just transition demands more than meeting extraction quotas; it requires a deep commitment to stewardship and global shared rules.

As the BRICS+ and G7 alliance continue to redraw the map of global resource fault lines, the ultimate measure of success will be our ability to deliver justice alongside technological progress. Only by balancing the urgent need for lithium and rare earth elements with human rights can we ensure this energy revolution breaks the cycle of historical exploitation.

Essential Guide to the Global Critical Mineral Race and Resource Geopolitics

1. What defines a mineral as ‘critical’ for the green energy transition?

Critical minerals are raw materials like lithium and cobalt essential for high-tech manufacturing, though they remain vulnerable to supply disruptions due to heavy geographical concentration.

2. How is the G7 alliance responding to the BRICS+ grip on rare earth elements?

The G7 alliance is launching the Minerals Security Partnership to diversify supply chains and secure alternatives through ‘friendshoring’—the practice of sourcing materials from trusted political allies.

3. Where are the primary centres for global lithium production located?

Most global lithium production is concentrated in the ‘Lithium Triangle’ of Chile, Argentina, and Bolivia, alongside significant mining operations in Australia and China.

4. Why is Arctic mineral security in Greenland a geopolitical priority?

Greenland holds 25 of the 34 critical raw materials identified by the EU, making its untapped rare earth deposits vital for Western energy independence.

5. What makes Venezuela’s Orinoco Mining Arc potentially significant?

The Orinoco Mining Arc contains trillions of dollars in gold, coltan, and rare earths, representing a major underdeveloped prize in the global mineral race.