The long-promised era of solid-state energy storage has officially transitioned from the confines of research laboratories to the harsh realities of the open road. As we enter 2026, the global automotive industry is no longer debating the theoretical viability of solid-state cells; instead, manufacturers are competing on the metrics of mass-market affordability and industrial yield. This shift represents a fundamental pivot in the electric vehicle (EV) narrative, moving away from incremental lithium-ion improvements toward a radical reimagining of energy density and safety.

The urgent requirement to eliminate range anxiety and diminish the carbon footprint of battery manufacturing drives this massive technological pivot. By replacing volatile liquid electrolytes with robust solid-state architectures, engineers are successfully unlocking the potential of lithium-metal anodes—a feat once thought to be decades away. The results are visible in everything from long-range executive sedans logging record-breaking single-charge journeys to affordable hatchbacks integrating semi-solid packs into existing production lines.

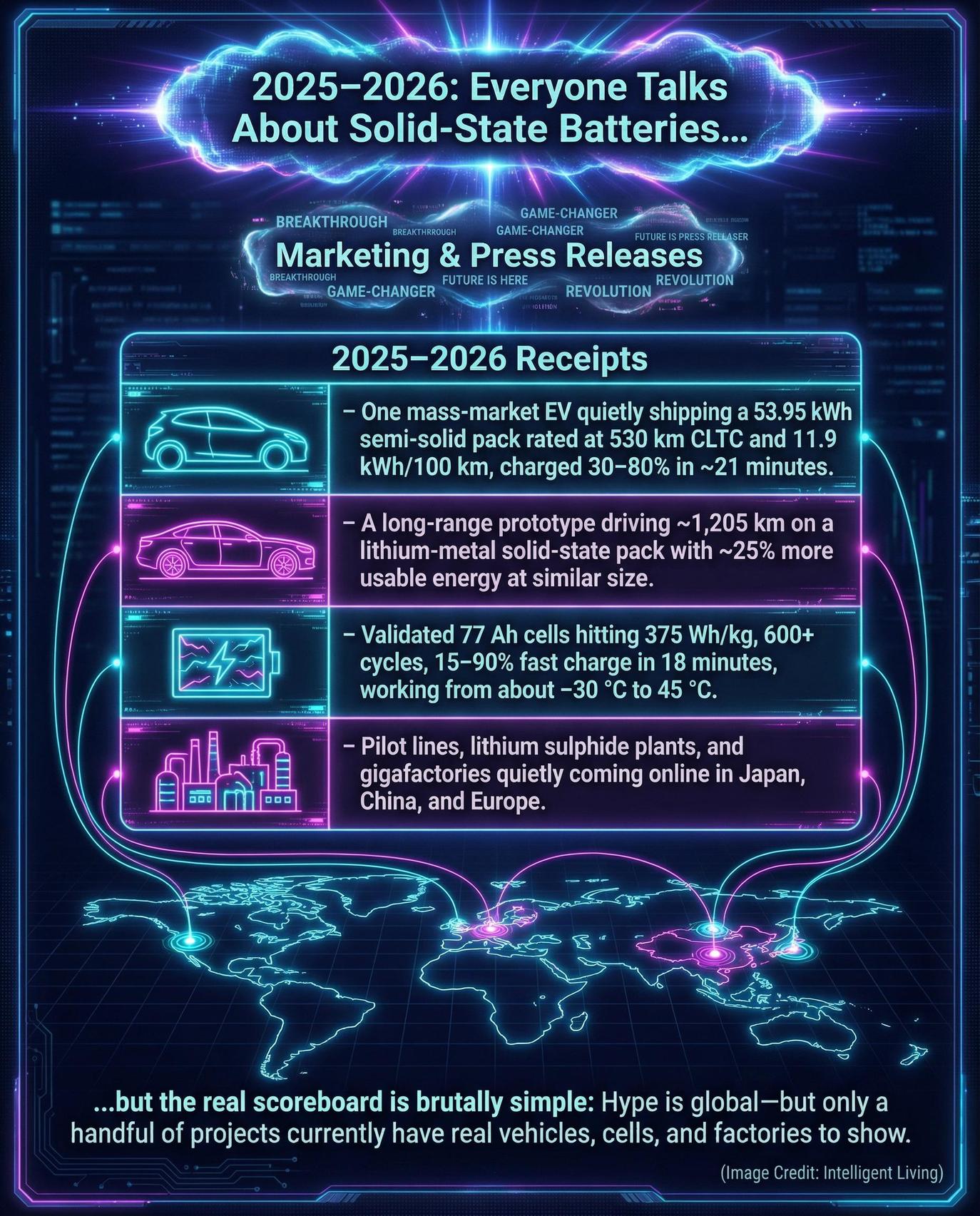

Navigating the current state of the industry requires an analytical breakdown of the technical milestones defining the 2025–2026 cycle. Readers will conclude this report with a clear understanding of which solid-state battery technologies occupy real vehicles and which remain confined to pilot lines. We focus on the pilot production scaling efforts that are currently defining the winners of the 2025–2026 cycle.

Solid-State Battery Milestones 2025–2026: Strategic Facts, Specs, and Deployment Timelines

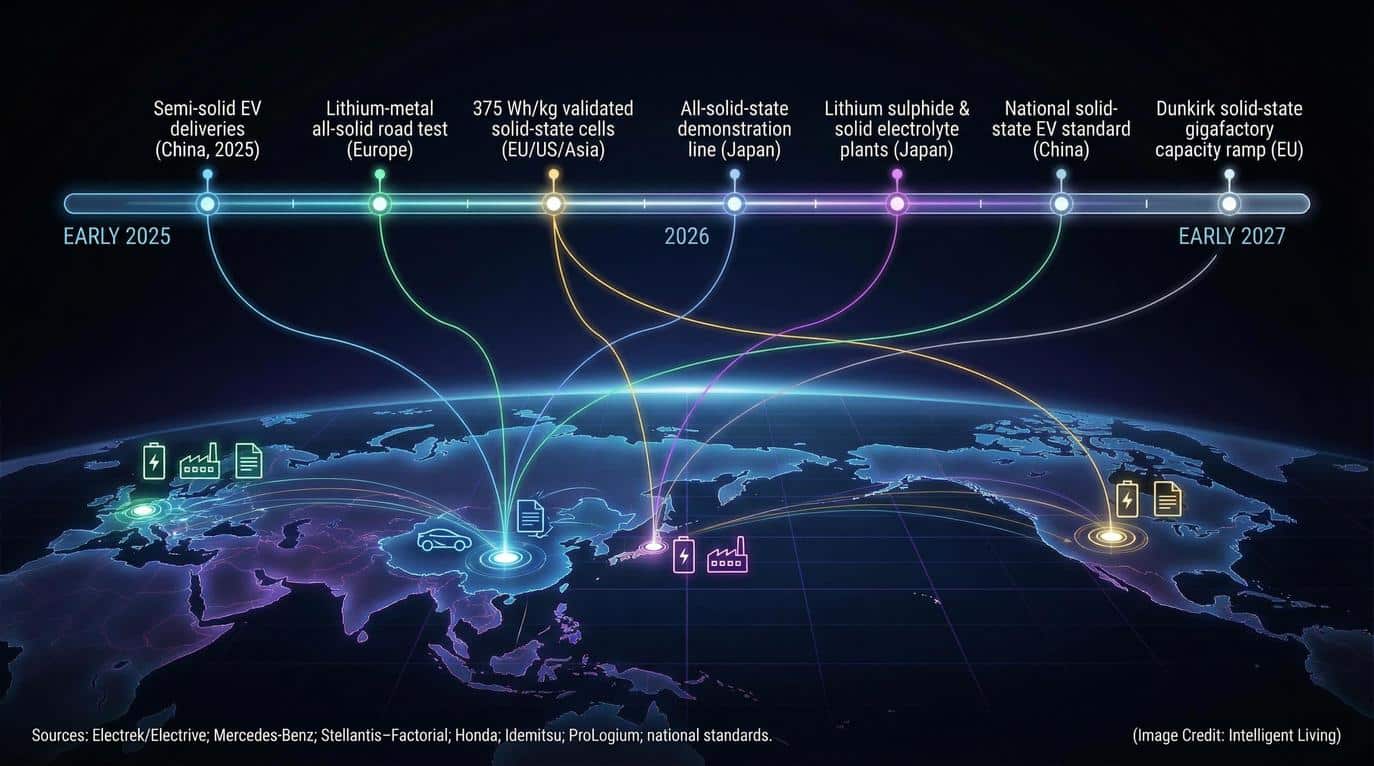

- A semi-solid-state battery entered real customer deliveries in late 2025 in a production MG4 variant in China, with production MG4 variants now reaching consumers as the first affordable electric cars equipped with a semi-solid pack.

- A lightly modified Mercedes-Benz EQS prototype equipped with a lithium-metal solid-state pack completed a single-charge journey of 1,205 kilometers under rigorous test conditions.

- BMW began testing all-solid-state cells from Solid Power inside a BMW i7 development vehicle, advancing from bench tests to full-vehicle integration inside a BMW i7 development platform.

- Stellantis and Factorial Energy validated 77-amp-hour FEST cells with a reported energy density of 375 Wh/kg, over 600 cycles, and 15 to 90 percent fast charging in 18 minutes at room temperature, based on their joint Stellantis–Factorial solid-state validation update.

- Honda began operating an all-solid-state battery demonstration line in January 2025 to verify mass production technologies and cost structures, as outlined in the company’s Honda solid-state demo line announcement.

- Nissan established a concrete timeline for its solid-state EV transition, targeting a pilot production line and full commercialization by fiscal 2028. Integrating the technology into its next-generation platform strategy allows Nissan to solidify its commercialization roadmap, as outlined in Nissan’s solid-state battery and gigacasting roadmap reported by Reuters.

- China launched a public consultation for its first national solid-state EV battery standard in late 2025, and China’s draft national solid-state EV battery standard outlines terminology and classification.

Technical Classifications: Distinguishing Real-World Performance Claims from Laboratory Concepts

Before reviewing milestones, it is essential to clarify terminology. Not all so-called solid-state batteries are the same. Market readiness hinges on this technical distinction; semi-solid systems offer immediate industrial scaling, while all-solid-state architectures undergo extended validation.

As China moves toward a national standard for solid-state batteries, terminology is becoming more formalized, reducing the marketing ambiguity that has surrounded the field. National strategy and industrial scaling are central to this broader policy coordination, mirroring themes found in current Chinese battery initiatives.

Defining Semi-Solid-State Hybrid Systems

A semi-solid-state battery, sometimes described as a liquid-solid hybrid, reduces the amount of liquid electrolyte without eliminating it entirely.

Specific implementations, such as the MG4 variant delivered in late 2025, reportedly contain roughly 5 percent less liquid electrolyte than conventional packs. This design prioritizes safety and density improvements while utilizing existing manufacturing infrastructure.

Characteristics of All-Solid-State Architectures

An all-solid-state battery replaces the liquid electrolyte entirely with a solid material. The solid electrolyte can be sulfide-based, oxide-based, halide-based, or polymer-ceramic composite. These materials aim to enable lithium-metal anodes, which store more energy per unit weight than the graphite anodes used in most current lithium-ion batteries.

Mass-Market Deployment: The Arrival of Consumer-Facing Semi-Solid EVs

SAIC MG4 Anxin Edition with Semi-Solid Battery

Status: Delivered to Customers

In December 2025, SAIC’s MG brand began delivering a version of the MG4 equipped with a semi-solid-state battery. According to reporting by Electrive, the pack has a capacity of 53.95 kilowatt-hours and delivers a rated range of 530 kilometers under the Chinese CLTC test cycle.

The manganese-based battery utilizes a specialized formulation that significantly reduces liquid electrolyte volume. It supports 2C fast charging, with a reported 30 to 80 percent charge window completed in 21 minutes. The vehicle uses a 120-kilowatt motor.

For readers unfamiliar with test cycles, CLTC stands for China Light-Duty Vehicle Test Cycle. It typically produces higher range figures than Europe’s WLTP or the U.S. EPA cycle. This does not invalidate the achievement, but it is important context when comparing vehicles across regions.

Strategic Significance: Evaluating The Bridge to Mass-Market Solid-State EV Readiness

The significance of the MG4 milestone is not that it delivers fully solid electrolyte chemistry. Instead, it marks a bridge moment. A semi-solid configuration entered a mass-market electric vehicle at competitive pricing, demonstrating that incremental solid-state elements can be commercialized without waiting for full lithium-metal architectures to mature.

Earlier transitions in battery history reflect a similar incremental path, where manufacturers improved chemistry gradually rather than switching systems overnight. It also aligns with broader industry experimentation around sodium-ion and hybrid chemistries, including efforts to develop solid-state sodium-ion batteries that utilize alternative chemical frameworks.

Prototype Road Validation: Proving All-Solid-State Reliability in Real-World Conditions

Mercedes-Benz EQS Solid-State Demonstrator

Status: Road-Tested Prototype

In 2025, Mercedes-Benz revealed a solid-state battery prototype installed in an EQS test vehicle. The company reported that the vehicle completed a 1,205-kilometer journey between Stuttgart and Malmö on a single charge under test conditions. According to the official Mercedes-Benz technology release, the solid-state pack offered about 25 percent more usable energy compared with a similarly sized conventional lithium-ion battery.

Mechanical Stability Benchmarks: Managing Lithium-Metal Expansion in High-Density Packs

The inclusion of pneumatic actuators represents a significant engineering shift in managing lithium-metal cell expansion. Lithium-metal anodes can change volume as they charge and discharge, creating mechanical stress at the interface between the anode and the solid electrolyte. By actively managing this pressure, engineers aim to prevent cracks and maintain stable contact. Similar cell-level design thinking underlies breakthrough solid-state battery architecture work that aims to combine high power delivery with long cycle life.

Solid-state battery development encompasses mechanical design and packaging just as much as fundamental electrochemistry.

BMW i7 with All-Solid-State Cells from Solid Power

Status: Test Vehicle Integration

BMW began operating a test vehicle based on the BMW i7 platform using all-solid-state battery cells from Solid Power. Unlike laboratory coin cells, these are automotive-scale cells integrated into a real vehicle architecture.

BMW further solidified its position by expanding collaborations with Samsung SDI and Solid Power to accelerate the validation of all-solid-state architectures. Validating cells for vibration and crash safety represents a crucial, though less visible, milestone in the automotive qualification process.

The success of both Mercedes and BMW demonstrates that all-solid-state batteries have successfully transitioned from research labs into rigorous vehicle testing environments, even if they have not yet reached the consumer market.

Stellantis and Factorial Energy 77 Ah Cells Bridging Gap to Industrial Mass Production

Between a laboratory breakthrough and a production vehicle lies a less glamorous but decisive stage: validated automotive cells.

Status: Validated Cells, Pre-Production Stage

In April 2025, Stellantis and Factorial Energy announced validation of 77-amp-hour solid-state battery cells. The companies reported an energy density of 375 watt-hours per kilogram, more than 600 charge cycles, and rapid charging from 15 to 90 percent in 18 minutes under stated test conditions, benchmarking performance alongside solid-state metal battery research boosting EV range to 800 kilometers.

Energy density, measured in watt-hours per kilogram, indicates how much energy a battery stores relative to its weight. A higher number allows longer-range or lighter vehicles. High-performance lithium-ion packs currently utilized in the market typically range between 250 and 300 Wh/kg at the cell level, while the highest-density lithium batteries from Amprius push experimental designs even further.

Cycle life, measured in charge-discharge cycles, indicates how many times a battery can be recharged before its capacity drops significantly. Six hundred cycles at high energy density is a meaningful engineering benchmark, but scaling that performance consistently across thousands of packs remains a manufacturing challenge, as highlighted by work on new EV battery fabrication techniques that make safer cells.

Validated cells offer proof of performance in controlled environments, though they do not yet guarantee final cost targets or factory yields. Still, they mark a transition from experimental chemistry to pre-production engineering.

Industrial Infrastructure Check: Pilot Lines, Precursor Plants, and Supply Chain Receipts

If delivered vehicles and road-tested prototypes are visible milestones, solid-state battery pilot lines are the industrial receipts that determine whether a technology can scale.

Honda Demonstration Production Line

Status: Demonstration Line Operational

Honda announced that it would begin operating its all-solid-state battery demonstration line in January 2025. The stated goal was to verify mass production technologies and cost structures, not merely to optimize electrochemical performance.

The distinction between laboratory batching and industrial reproducibility dictates the ultimate economic success of the technology. By launching a demonstration line, Honda signaled that its focus was shifting toward reproducibility and industrial efficiency.

Nissan Pilot Line and Commercialization Window

Status: Pilot Production and Target Timeline

Nissan outlined its plan to advance solid-state battery development with a pilot production line and a commercialization target around fiscal 2028 to 2029. According to Reuters coverage, the company is integrating a solid-state strategy into a broader next-generation EV platform approach.

While these timelines remain forward-looking, the existence of a pilot line suggests that Nissan has moved beyond exploratory research into structured pre-production development.

Materials and Supply Chain Scaling

The successful scaling of solid-state batteries depends as much on upstream material availability as it does on final cell assembly. Throughout 2025, several key partnerships focused on securing the chemical precursors necessary for high-volume production:

Strategic Precursor Supply Chains: Scaling Specialized Electrolyte Materials

- Idemitsu Kosan Lithium Sulfide Facility: Planned to support Toyota’s roadmap, this plant targets an annual output of 1,000 tons of lithium sulfide to support Toyota’s long-term roadmap.

- Toyota–Sumitomo Cathode Program: This collaboration aims to mass-produce specialized cathode materials tailored for solid-state environments by fiscal year 2028.

- Pilot Electrolyte Production: Newer updates confirm that pilot production of sulfide-based electrolytes is already underway to validate future EV compatibility.

Maturity within the supply chain is now evidenced by these industrial receipts, showing that precursors are scaling in tandem with cell research. By focusing on precursors like lithium sulfide, manufacturers are addressing the primary bottleneck to mass-market adoption.

Critical Minerals, Lithium Supply, and Circular Battery Economics

Earlier reporting on lithium supply constraints and mineral transparency is echoed by these recent supply chain developments, as manufacturers navigate global lithium supply constraints and breakthroughs in critical mineral discovery. Solid-state batteries may reduce some of the risks linked to volatile metal markets, but they introduce new dependencies, particularly around specialized electrolyte materials, high-purity precursors, and the development of a circular battery economy built around recycling and transparency.

In late 2025, China launched a public consultation for its first national standard dedicated to solid-state batteries for electric vehicles. According to reporting by Gasgoo, the draft standard addresses terminology, classification, and coding rules.

Standards as Hidden Infrastructure of Solid-State Scaling

While often overlooked, industry standards are the invisible force that shapes emerging markets. Clear definitions eliminate the confusion between semi-solid and all-solid systems, providing a unified framework that lowers uncertainty and accelerates global industrial coordination.

Viral headlines rarely emerge from pilot lines or standards committees, yet these elements determine which companies will ultimately ship at scale.

Technical Reliability Audit: Scientific Control Points for Mass Manufacturing

Materials, Factories, and Standards

Solid-state batteries rely on specialized materials that currently lack the massive production scale of conventional lithium-ion components. Sulfide electrolytes, for example, require exceptionally high-purity lithium sulfide and rigorous moisture control during every stage of handling.

Even minor contamination can drastically reduce ionic conductivity or trigger unwanted side reactions. Consequently, upstream infrastructure projects—including electrolyte precursor plants and the expansion of solid-state gigafactories in Dunkirk—are now considered as critical to success as the performance of the validated cells themselves.

Recent signals include electrolyte plant investments linked to Toyota’s roadmap and ongoing factory buildouts across Europe.

Emerging solid-state battery standards aim to formalize these definitions and testing protocols. By reducing the confusion between semi-solid and all-solid systems, these standards lower regulatory uncertainty and encourage industrial coordination.

Research Breakthroughs Targeting Real Failure Modes

Progress in 2025 and early 2026 focused on known bottlenecks rather than headline claims.

Interface stability remains central. A 2025 Nature Energy study on lithium-metal solid electrolytes demonstrated higher lithium plating currents without dendrite formation through engineered solid interfaces, a step toward safer fast charging.

Mechanical brittleness is another constraint. Research in Nature Communications on mechanically robust halide electrolytes proposed defect-based toughening strategies to reduce cracking during lithium expansion and contraction.

Interphase chemistry also limits durability. Studies in 2025 and early 2026, including a Joule study on electric-field-modulated interphases, examined interphase control in lithium-metal and anode-free architectures, improving understanding of long-term degradation.

Technical uncertainty diminishes as these advances refine interfaces and mechanics, though manufacturing yields remain the decisive factor.

Global Competitive Landscape: National Strategies and Future Market Positioning

National Strategic Initiatives: Comparing Deployment Models

Solid-state battery development is embedded in national strategy.

- Japan emphasizes structured scaling through demonstration lines and defined commercialization windows.

- China combines pilot deployment with standards coordination.

- Europe prioritizes localized gigafactories and industrial sovereignty.

- In the United States, partnership-driven models link technology developers with major automakers.

- Corporate roadmaps from Samsung suggest that premium vehicles will serve as the initial entry point for solid-state deployment. This rollout aligns with Samsung’s long-range solid-state EV battery roadmap, pointing toward premium models as early adopters.

Manufacturers across the globe are now locked in a race to prove that solid-state technology can be both reliable and affordable on the assembly line. The competition centers on manufacturing reliability and cost control rather than laboratory novelty.

Adjacent Adoption Before Mainstream Cars

Early adoption of solid-state battery technology is likely to occur outside the mass-market passenger vehicle segment. Industries such as robotics, aerospace, and specialized premium mobility platforms can justify higher initial costs in exchange for meaningful gains in safety and energy density.

Simultaneously, grid and infrastructure projects are diversifying the energy landscape with alternative chemistries. These include utility-scale energy storage systems, iron-air batteries for grid applications, and long-duration thermal sand batteries, all of which expand the utility of advanced storage far beyond the automotive sector. Limited production in these sectors can validate durability before broader rollout.

What this Means in 2026

Market signals indicate a strategic transition rather than a sudden replacement of existing battery technologies. Conventional lithium-ion continues to improve and will remain widely deployed. The near-term outlook is coexistence, with gradual expansion of semi-solid and early solid-state systems while full industrial scale is still being proven.

Scaling the Future: The Final Verdict on Solid-State Commercialization

The progress observed throughout 2025 and early 2026 confirms that solid-state batteries are no longer a ‘forever technology’ relegated to a distant future. The arrival of semi-solid vehicles in the consumer market and the successful road validation of all-solid-state prototypes mark the beginning of a multi-stage industrial rollout. While conventional liquid lithium-ion packs will remain the backbone of the global EV fleet for several years, the high-performance benchmark has officially moved toward solid-state architectures that offer superior safety and unprecedented energy density.

Success in the coming years will not be measured by laboratory energy density records, but by the ability of manufacturers like Toyota, Nissan, and Honda to stabilize supply chains and achieve consistent factory yields. As national standards for terminology and safety become finalized, the ambiguity surrounding solid-state claims will evaporate, leaving only the most durable and cost-effective technologies standing. The scoreboard is currently in flux, but the infrastructure being built today ensures that the next generation of mobility will be defined by solid-state reliability.

Manufacturers look to these signals to determine the rate at which solid-state batteries are evolving into durable infrastructure. These metrics fit alongside frontier concepts such as lithium-air battery research utilizing porous carbon and other next-generation energy storage methods. Furthermore, global manufacturers look to global solid-state manufacturing commitments to move past the uncertainty of pilot projects and toward visible production commitments.

The solid-state battery landscape of 2026 remains a dynamic scoreboard where MG4 deliveries and Toyota pilot lines serve as the primary metrics for future energy density scaling. It is simply still early in the season.

Solid-State Battery Technology: Frequently Asked Questions 2026

How do Semi-Solid and All-Solid Battery Architectures Differ?

Semi-solid architectures provide a faster path to commercialization, whereas all-solid systems are designed for the next generation of high-density performance. Semi-solid systems provide a faster path to commercialization, while all-solid systems promise higher long-term energy density.

Why Are Pneumatic Actuators Used in Mercedes-Benz Solid-State Packs?

Managing the physical expansion of lithium-metal anodes requires these specialized mechanical components to ensure long-term cell durability.

Which Electric Cars Currently Use Solid-State Batteries?

As of early 2026, SAIC’s MG brand has delivered production vehicles with semi-solid packs, while premium prototypes from Mercedes-Benz and BMW are undergoing extensive public road validation.

What is The Role of Lithium Sulfide in Battery Scaling?

Lithium sulfide serves as a critical precursor for sulfide-based solid electrolytes, which are favored for their high ionic conductivity and compatibility with mass-production thermal processes.

When will All-Solid-State Batteries Reach Mass-Market Pricing?

Major manufacturers like Nissan and Toyota target 2028 to 2029 for full-scale commercialization, as pilot lines currently focus on optimizing manufacturing yields and reducing material costs.

Separating delivered products from prototypes provides a clearer perspective on the ongoing industrial transformation of the battery sector.